What Halloween Teaches Kids About Money

Don’t let personal finance spook your kids. There are lots of fun ways to talk about money. Here’s how you can use Halloween to explain money

A treasure trove of fun and educational articles for the whole family. Pocket money tips, recommended products, advice from experts, or just ideas on how to get the most out of the app. And be sure to check out our Primers, a set of bite sized guides on how to talk to kids about money.

Don’t let personal finance spook your kids. There are lots of fun ways to talk about money. Here’s how you can use Halloween to explain money

Secondary school brings greater choice and complexity, especially in the canteen. Here’s how to work out the money side, and more…

Many parents worry about how much time their children should spend staring at screens. Nowadays, we’re surrounded by televisions, smartphones, tablets, gaming consoles and computers. Here’s some help on how to manage it all.

we’ve shortlisted our top picks on Alexa skills that are great for children and families.

Compound interest is the super power that expands your savings – or makes a mountain of debt. The earlier you understand compound interest, the earlier you can start making the most of it!

We know saving for your children is high on many parent’s list of priorities and can become stressful when you think of all the things you would like to help your little ones with. So here’s a few tips to get you started.

Talking about the different methods can help kids realise plastic cards aren’t a magical source of money!

It may just seem like another expense in the long list of regular outgoings, but there’s a number of very good reasons behind why we’ve been giving a regular amount of money to children for the past two hundred years. So let’s look at the advantages of giving pocket money!

No-one likes thinking about death, but if the worst should happen, life insurance can help protect your nearest and dearest from money worries. Here’s our simple guide on what to consider.

Sadly, money doesn’t always appear magically as pocket money or birthday presents. Helping kids earn cash, rather than just handing it out, can teach them about the value of money.

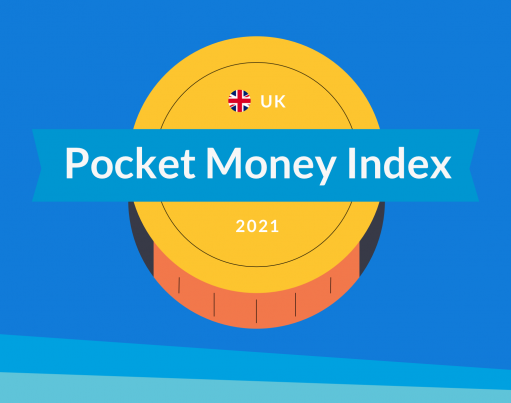

Our Pocket Money Index is an annual snapshot of the monetary habits of kids aged 4-14 across the UK. Whether it’s the average allowance given per week, or the amounts paid for household chores are, you’ll find it all here.

A glimpse into the habits of young pocket money earners in the US

A glimpse into the habits of young pocket money earners in Australia